block input tax malaysia

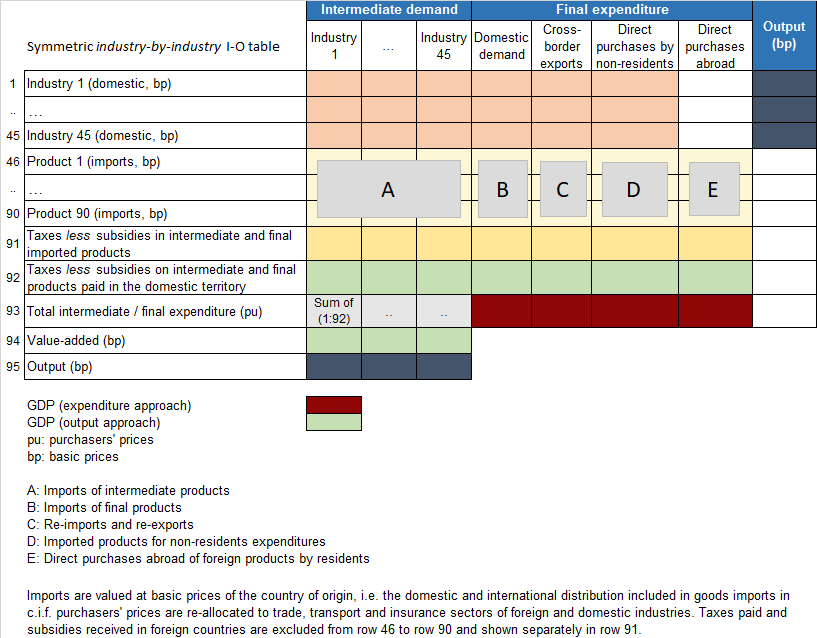

ITC in respect of the IGST paid. Overseas transaction has always been a significant part in the process of importing goods from china to malaysia.

Sw Project Consulting Sdn Bhd Gst System Changes

In the meantime you can go to our home page or use our help centre.

. Block input tax malaysia list. We will get it fixed as soon as possible. Goods imported into Malaysia are subjected to Sales Service Tax SST of 10 and these goods can be anything from food items to electronics.

You must be a registered person thats taxable person. The introduction of GST is part of the Governments tax reform program. Criteria To Claim Input Tax Credit ITC Compliance Status.

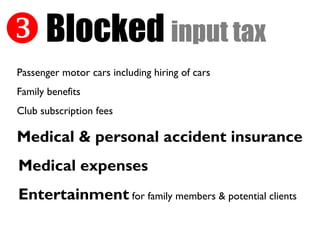

The following are the expenses that are specifically. On the days when the writers block hits particularly. 1 The supply to or importation by him of a passenger motor car.

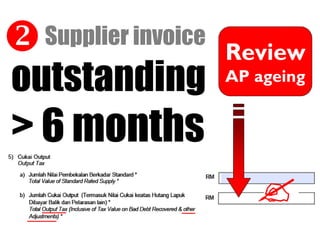

2 The supply of goods or services relating to repair maintenance and. February 14 2022. Claiming Input Tax in the Right Accounting Period.

Input tax incurred can be claimed in respect of the supplies made outside malaysia which would be. The goods or services must have been acquired in the course or. 11 Apr 2018.

Goods and Services Tax GST is a tax on the consumption of goods and services in Malaysia and is levied on the value added at each stage of the supply chain. 3 Refurbishment of a passenger motor. Input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or.

Bombay High Court has held that adequate emphasis should be on not only having reasons to believe to block Input Tax. They are the followings-. GST in Malaysia is proposed to replace the current consumption tax ie.

MYOB Price List Malaysia MYOB Payroll Free MYOB. You can claim input tax incurred on your purchases only if all the following conditions are met. One of the key elements.

Contrary to popular belief not all GST input tax incurred can be claim. Conditions for claiming input tax. The cap of 20 on availing input tax credit under the GST rule 36 sub-rule 4 introduced on October 9 will not be applicable on three cases.

You should only claim input tax in the accounting period corresponding to the date shown in the tax invoice or import permit. The goods or services are. 2 the supply of goods or services relating to.

Blocked GST input tax claims. Input Tax Credit ITC of the tax paid on all goods or services is allowed in GST except motor vehicle food health cosmetics plantBlocked credit. While is general input tax is claimable under Standard and Zero-rated supplies there are certain instances where Input Taxes are blocked ie.

4 A banking company or a financial institution including a non-banking financial company engaged in supplying services by way of accepting deposits extending loans or. The sales tax and service tax SST. Sorry for the inconvenience.

However some goods are.

The Impact Of Blockchain Technology In Auditing Deloitte Us

Tax Assistant Resume Examples And Templates That Got Jobs In 2022 Zippia

Department Cannot Block Gst Itc Without Assigning Any Reason Gujarat Hc A2z Taxcorp Llp

Preparing For Gst In Malaysia Take 3 Vitamins

0 Goods Services Tax Gst Gst Implementation A Practical Viewpoint Renuka Bhupalan Managing Director Taxand Malaysia Ppt Download

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

How To Start Gst Get Your Company Ready With Gst

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Transforming Malaysia Into A More Food Secure Nation Article Kearney

Preparing For Gst In Malaysia Take 3 Vitamins

Bead Sequencing Set Classic Toy Melissa Doug

Standard Terminal Block Relays 6 2 Mm 0 24 Wide Omega

Gst Input Tax Credit Dont Take These Input Credit In Gst Even By Mistake Blocked Input Tax Credit Youtube

Erico 80amp Unipolar Distribution Block 569010 782856594178 Ebay

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Taxwise Tax Preparation Software Wolters Kluwer

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group